Can DevOps solve banking apps’ payday meltdowns?

Lessons learnt from banking apps fallout in February, and how banks can prevent another payday nightmare.

Payday should be a moment of relief. A time to settle bills and breathe easy, but for customers on February's payday, it was anything but relaxing. Widespread mobile app crashes left millions unable to access their online banking, causing frustration and chaos when they needed their money the most.

For customers relying on these apps to access their salaries, pay bills, and manage finances, the disruption was more than an inconvenience, but a crisis. With only 23% of Brits trusting finance apps, incidents like this only deepen the skepticism. But why did this happen, and how can banks ensure it doesn’t happen again?

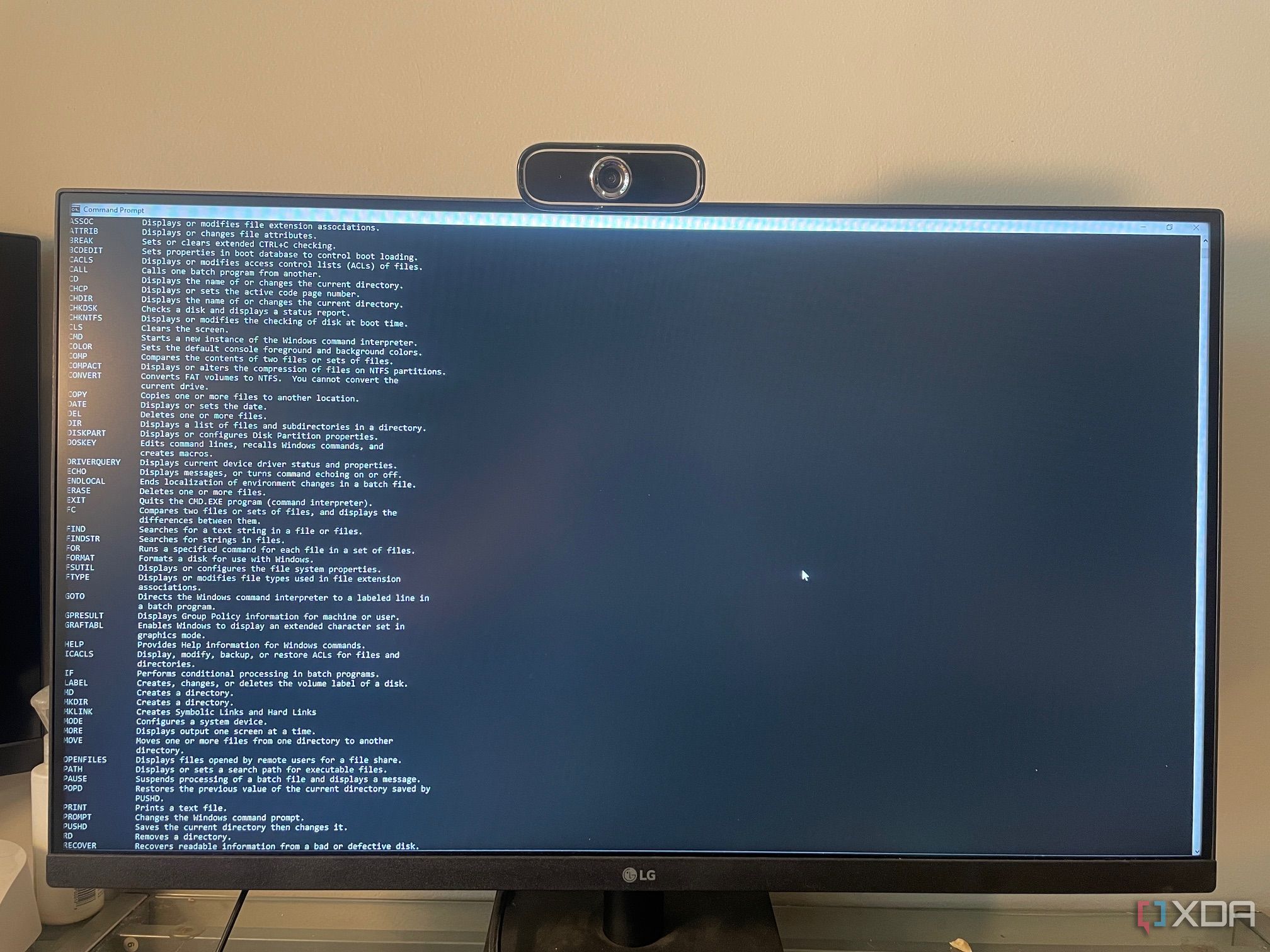

Out-of-date legacy systems under pressure

As banking shifts from branches to mobile and internet banking, legacy systems face mounting pressure to interact seamlessly with third-party services, and support a wide range of devices and software versions, from cloud services and APIs to mobile platforms. This intricate web of dependencies massively increases the risk of failure, especially during peak periods like payday. Without a structured approach to change, even minor updates can trigger outages.

To reduce these risks, banks need to introduce changes progressively and in a controlled manner. Uncontrolled deployments can cause widespread outages and damage customer trust which is something no bank can afford to lose. The solution? A DevOps approach designed to stabilize the system and protect the customer experience.

DevOps for banking stability

To prevent major disruptions, and strengthen the resilience of banking applications, DevOps best practices must be integrated into the development and deployment process.

1. Progressive rollouts prevent widespread failure

Deploying new features or updates to all users simultaneously can be a recipe for disaster. Instead, progressive rollouts ensure a controlled, phased introduction of changes, starting with a small segment—perhaps 1%, then increase to 5%, and 10%—moving to the next group only when confident in the stability of the code.

By gradually introducing changes, banks can check performance and detect potential issues before they impact the entire customer base. Controlled rollouts means fewer surprises and happier customers.

2. Automated monitoring and instant rollbacks for reliability

You can’t fix what you can’t see. Automated monitoring tools can track key performance indicators (KPIs), such as response times, error rates, and system load in real time, providing immediate alerts when something goes wrong.

The ability to instantly rollback to a previous version is critical, ideally within 200 milliseconds or less. This keeps banking apps reliable, even during high traffic periods.

3. Rapid adjustments without downtime

Not all changes require a full-scale code deployment. Runtime configuration management allows developers to make real-time adjustments without redeploying the entire application.

This means if an issue arises with a new feature, banks can instantly disable it without taking down the entire application. Such flexibility is crucial for maintaining uptime and ensuring a seamless customer experience, even in unpredictable situations.

4. Targeted segments for customized experience

A one-size-fits-all approach doesn’t work in banking. Customers use different devices, operating systems, and network environments, so why treat them all the same.

By segmenting users based on key attributes, banks can tailor updates to specific groups. This allows them to optimize the user experience, mitigate risk, and enhance security, without disrupting the entire customer base.

The future of resilient banking apps

Payday is a crucial, recurring event worldwide, and banking apps have become essential gateway for consumers to manage their finances. In fact in the UK alone, 37% of UK residents check their current account balance daily. This is proof that reliable digital banking is no longer a convenience, but an exception.

Banks cannot afford another payday failure. By embracing DevOps best practices—progressive rollouts, automated monitoring, and real-time configuration management—they can ensure the events of February’s payday aren’t repeated.

DevOps best practices from progressive rollouts to automated monitoring, runtime configuration management, and targeted segmentation, can guide banks through the innovation process without compromising the reliability of their platforms. Reliable apps build confident customers and it’s time for banks to deliver on that promise.

We list the best mobile payment app.

This article was produced as part of TechRadarPro's Expert Insights channel where we feature the best and brightest minds in the technology industry today. The views expressed here are those of the author and are not necessarily those of TechRadarPro or Future plc. If you are interested in contributing find out more here: https://www.techradar.com/news/submit-your-story-to-techradar-pro