Global server sales almost doubled in Q4 with annual run rate likely to smash $300 billion in 2025

Server market surges as global sales nearly double in Q4 2024, pushing annual revenue toward a staggering $300 billion milestone by 2025.

- IDC says AI demand drives hyperscalers to accelerate server infrastructure investments

- Super Micro challenges Dell with rapid revenue growth in 2024

- Nvidia leads GPU servers as AI adoption continues expanding rapidly

The global server market saw a record-breaking surge in the final quarter of 2024, with revenue nearly doubling compared to the same period in 2023.

New figures from IDC claim total server sales reached $77.3 billion in Q4 2024, marking a 91% year-over-year rise.

This rapid expansion, fueled by hyperscalers, cloud storage service providers (CSPs), and enterprises investing in high-performance computing, is expected to push the market past an annual run rate of $300 billion by 2025.

Record growth fuels server market expansion

A significant portion of this increase came from x86 servers, which saw a 59.9% revenue jump, while non-x86 servers experienced an unprecedented 262.1% year-over-year surge.

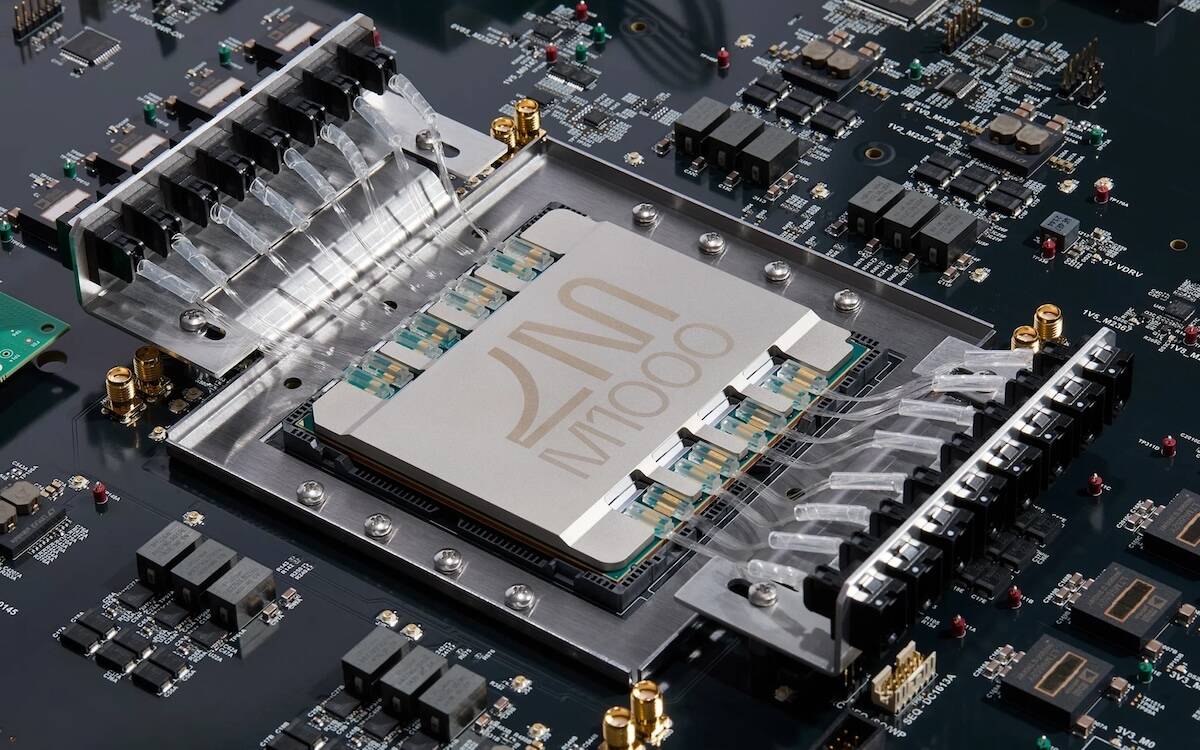

The growing adoption of AI-driven workloads has also contributed to the rise of servers equipped with embedded GPUs, with Nvidia maintaining a dominant 90% market share in this segment.

As AI integration accelerates, demand for high-performance servers, and the best dedicated server hosting providers, continues to reshape the industry.

Super Micro has also emerged as one of the fastest-growing server vendors, with its revenue surging by 55% in Q4 2024. With $5 billion in sales, it is now in a statistical tie with Dell Technologies, which saw a more modest 20.6% increase in revenue during the same period.

The company’s surge is largely fueled by demand for AI-optimized infrastructure, and best small business server solutions also favors other key players, including Hewlett Packard Enterprise, Lenovo, and IEIT Systems, all of which reported revenue growth exceeding 50% year-over-year.

“IDC expects AI adoption to continue growing at a remarkable pace as hyperscalers, CSPs, private companies, and governments around the world are increasingly prioritizing those investments,” said Lidice Fernandez, group vice president, Worldwide Enterprise Infrastructure Trackers.

“Growing concerns around energy consumption for server infrastructure will become a factor in datacenters looking for alternatives to optimize their architectures and minimize energy use”

Cloud service providers and hyperscalers accounted for nearly half of all server sales in Q4 2024, while ODM Direct category, comprising manufacturers that sell directly to large-scale operators like Amazon Web Services, Microsoft Azure, and Google Cloud generated a staggering $36.57 billion in revenue during the quarter, marking a 155.5% increase year-over-year.

This surge in spending reflects the increasing demand for the best web hosting and cloud computing solutions as organizations migrate more workloads to the cloud and invest in AI-powered infrastructure.

You may also like

- These are the best firewalls around today

- Take a look at the best business VPNs

- Thousands of websites have now been hijacked by this devious, and growing, malicious scheme

![At a Glance bug causing weather sync issues, forecast delays on Pixel [U]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2024/03/At-a-Glance-v1.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)