Microsoft earnings preview: Cloud and AI growth will be tested by larger economic turmoil

Microsoft’s business may not be as exposed to the risk of tariffs as some of its tech rivals, but economic uncertainty is still causing analysts to rein in their expectations ahead of the company’s earnings report Wednesday. Many businesses that drive Microsoft’s revenue are becoming more cautious in their spending on cloud computing, enterprise software, and AI services, according to analyst reports, citing information from Microsoft partners and customers. The trend could impact key Microsoft products such as its Azure cloud platform, Microsoft 365 enterprise subscriptions, and Microsoft 365 Copilot. Overall, analysts expect Microsoft to report revenue of $68.44 billion,… Read More

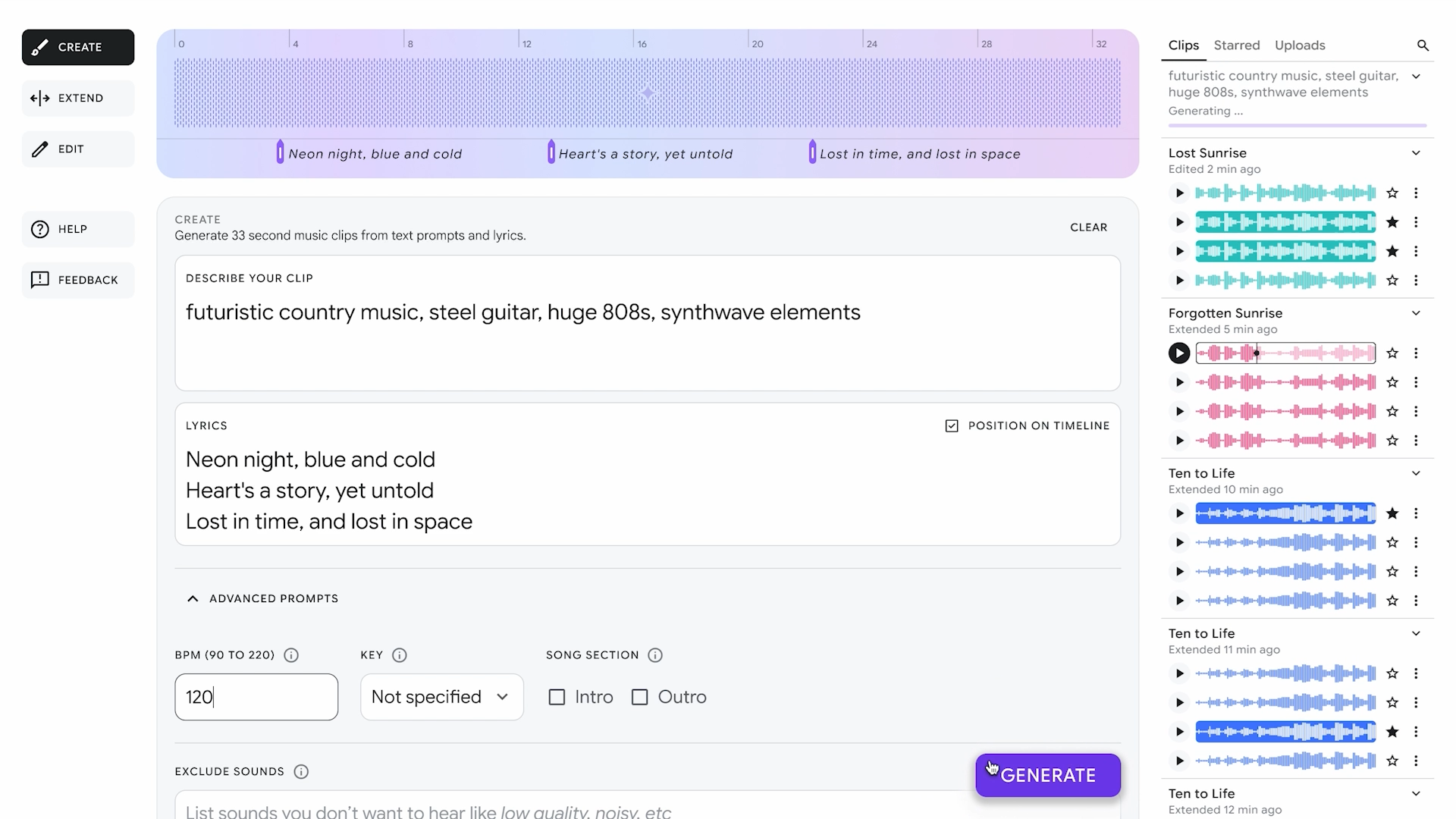

Microsoft’s business may not be as exposed to the risk of tariffs as some of its tech rivals, but economic uncertainty is still causing analysts to rein in their expectations ahead of the company’s earnings report Wednesday.

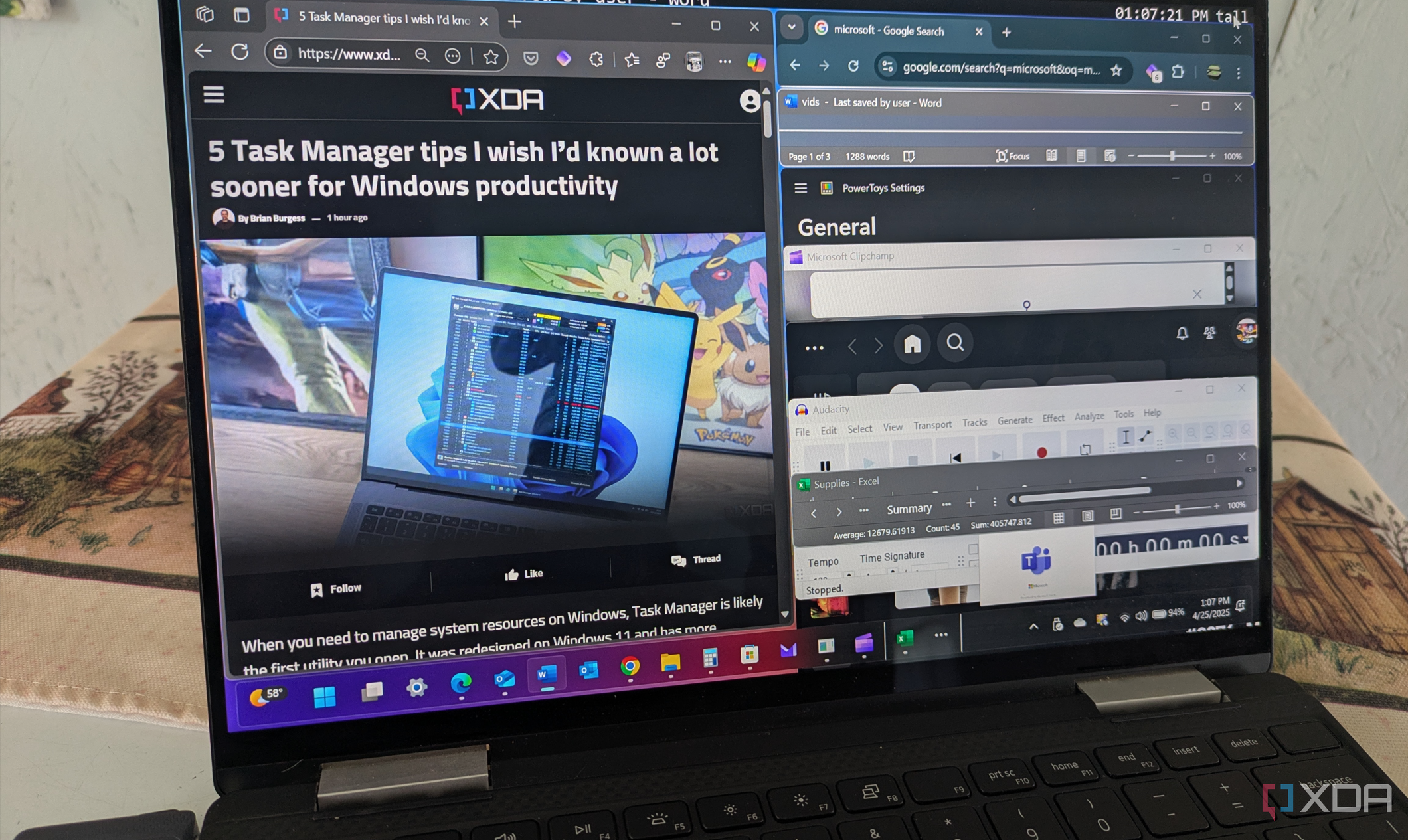

Many businesses that drive Microsoft’s revenue are becoming more cautious in their spending on cloud computing, enterprise software, and AI services, according to analyst reports, citing information from Microsoft partners and customers.

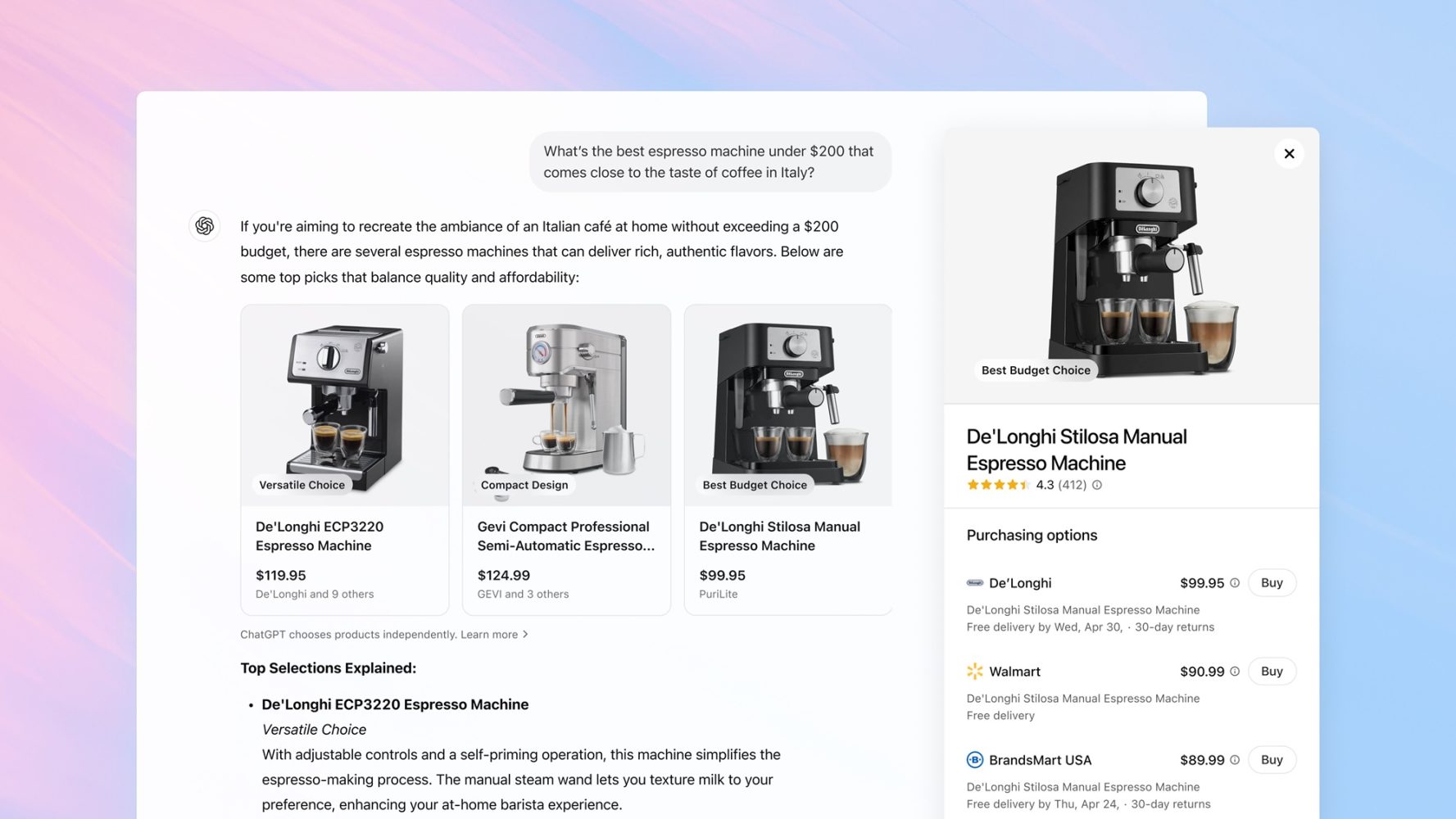

The trend could impact key Microsoft products such as its Azure cloud platform, Microsoft 365 enterprise subscriptions, and Microsoft 365 Copilot.

Overall, analysts expect Microsoft to report revenue of $68.44 billion, up 11% from a year earlier, and earnings of $3.22 per share, up 10% from a year ago.

Microsoft’s stock is down about 7% so far this year, while still outperforming many of its tech industry peers. The company generates a large share of its revenue from software and cloud services rather than hardware, making it less vulnerable to tariffs that primarily target goods and manufacturing.

Wall Street will be watching Microsoft’s results and outlook closely as a barometer for broader AI and business technology spending.

Here are some of the key trends and numbers to watch.

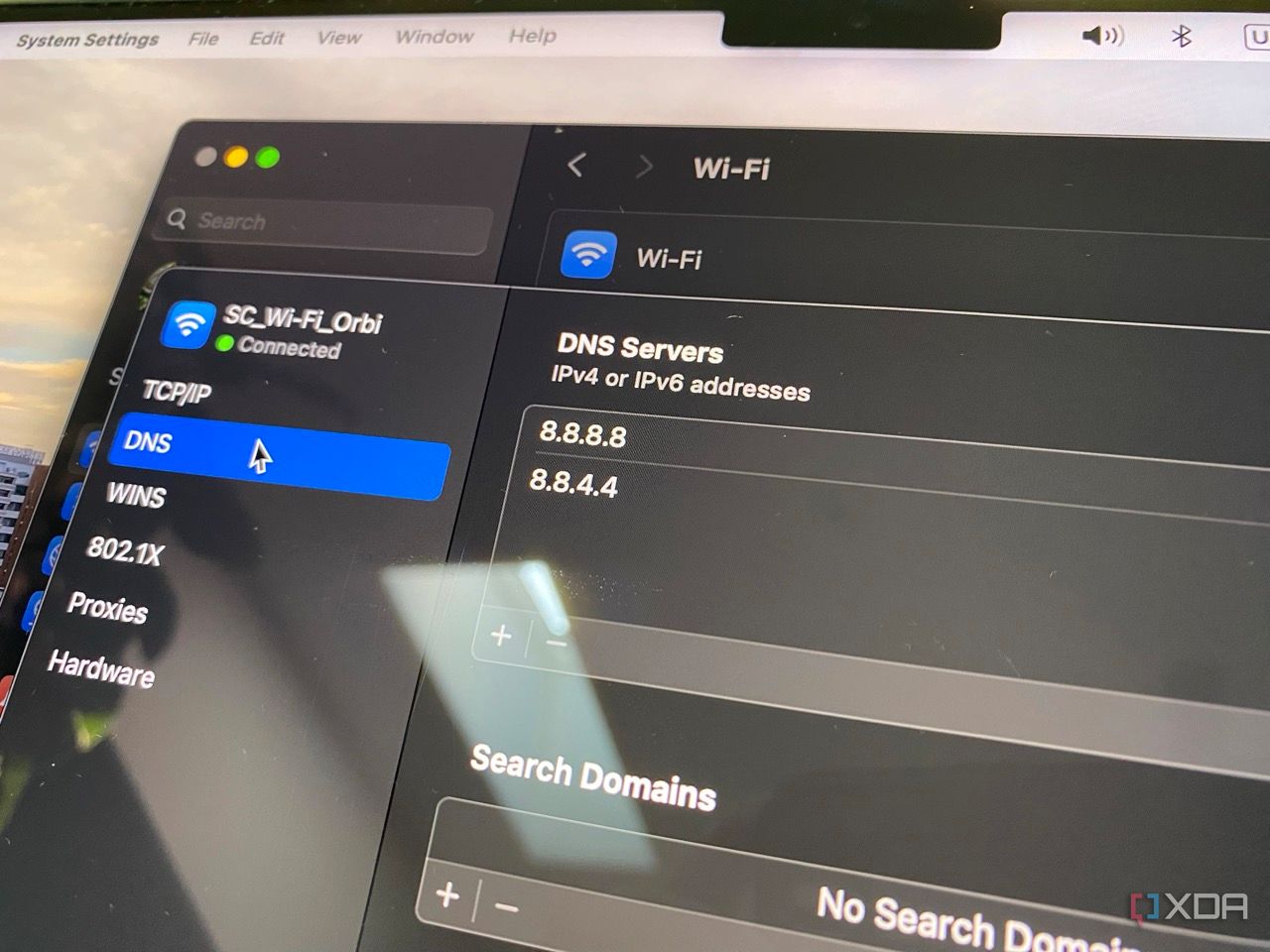

Azure cloud growth: Morgan Stanley cut its forecast for Azure’s growth to 31% for the March quarter, down from its earlier estimate of 31.5%. The firm said businesses are being more cautious about starting new Azure projects, and warned that growth could slow further later this year.

While customers aren’t pulling back sharply, many are “taking a ‘wait-and-see’ approach for now,” wrote Morgan Stanley analysts Keith Weiss and Josh Baer in their April 16 report.

Microsoft 365 Copilot adoption: Cantor Fitzgerald said interest in Microsoft’s Copilot AI assistant remains strong, but many customers are looking for more business justification before committing. To boost adoption, partners have been offering discounts as high as 40%.

“Interest remains very high, but increasingly customers are using [financial operations] teams and searching for business cases to justify the product,” wrote Cantor Fitzgerald analyst Thomas Blakey in an April 23 report.

PC market trends: Analysts noted that global PC shipments grew about 5% in the first quarter of the year, based on Gartner data — a positive sign for Windows revenue. However, tariffs and other uncertainties could still weigh on future PC sales, even if the immediate impact is limited.

AI revenue: Microsoft said in January that its AI products were generating revenue at a rate of $13 billion annually, up from $10 billion previously. Overall, Azure and other cloud services grew 31% year-over-year last quarter, with AI contributing 13 percentage points of that growth.

Capital spending: Microsoft has said it plans to spend more than $80 billion this year to grow its cloud and AI infrastructure. It reported capital expenditures of $22.6 billion in the second quarter, up 79% from a year earlier.

Analysts will be watching the capex trend closely amid reports that Microsoft has recently paused or canceled some early-stage data center projects.

Microsoft is scheduled to report earnings after the market closes Wednesday, April 30, with a call set for 2:30 p.m. Pacific time.